DESIGNING AURA’S OMNICHANNEL EXPERIENCE

OVERVIEW

Transition Aura’s B2B2C and B2C loan application product to an omnichannel experience.

PROBLEM

Aura’s Online and Retail loan applications existed in isolation due to technical limitations and rapid company growth. After the redesign of the Retail Application (see case study here) the backend was updated, allowing a customer to start an application in store and continue on their own device online, increasing a need for a seamless experience.

OUTCOME

The backend and risk model was improved to allow applicants of any partner to move seamlessly between Online and Retail at specified junction points, regardless of the channel in which they started. To help make that transition seamless a new design system was made and built (see design system case study), along with updated user flows.

ROLE

Product Designer

DESIGN PROCESS

01. DEFINE

When beginning this project, Product Manager Nick Friscia did much of the strategic lifting by looking into the user flows and distinguishing specific junction points in which the two experiences overlapped. While the Product Manager defined the business needs, I worked on defining the different users and understanding their characteristics.

What are the business goals?

Allow partners with limitations to take loan applications (eg. partners who can not disburse a loan).

Allow applicants to transition between channels.

Reduce training and partner agent dependency by creating customer autonomy.

Open a new growth channel

Define user-profiles and characteristics

We used data analytics to understand online customer conversion, device characteristics, etc.

We created Personas (see persona research here)

02. DISCOVER

Who are we designing for?

Primary user: Loan applicants (retail and online)

Secondary user: Partner Agent (retail only)

Tertiary user: Internal Aura Associate (over the phone apps)

Since loan applicants were the only users to jump between channels, we wanted to prioritize their experience. In order to do so, we needed to gain a strong understanding of who and what their needs were.

We used data analytics to understand online customer conversion, device characteristics, geography, etc.

We created Personas (see persona research here)

What are the existing channels and user flows?

Channels:

Online loan application

Retail loan application

Phone call loan application

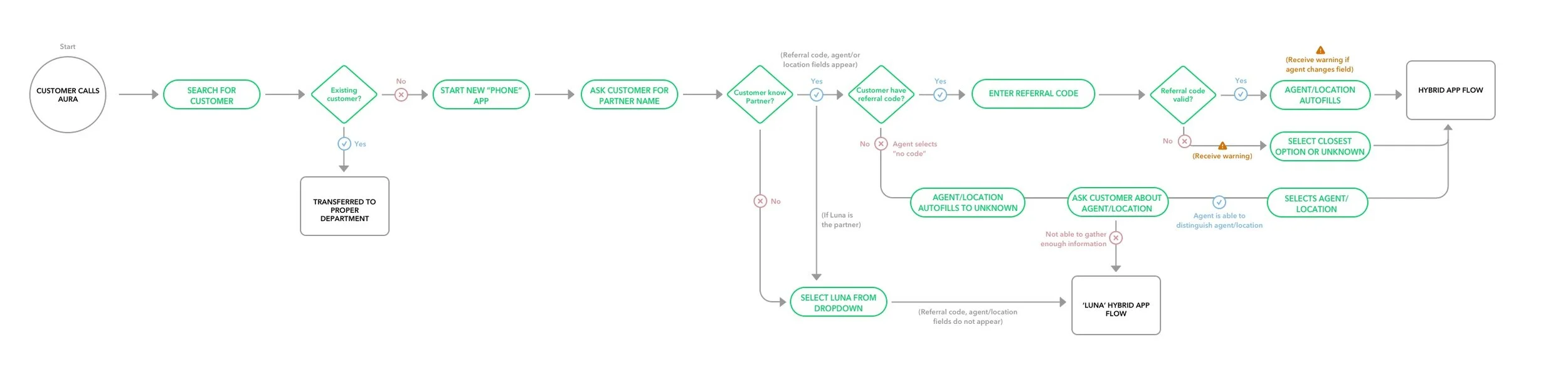

User Flows:

03. IDEATE

Since the project was heavy on the technical side, the designs were a representation of the solutions created by key stakeholders. We had a tight deadline and therefore moved quickly by having constant review sessions.

We worked closely with Engineering to make sure we covered all technical limitations and business requirements and mapped out how a customer would flow between the online and retail channels together.

Once we were aligned on the user flows, I worked on updating the UI with the new features and Aura brand (see Aura Rebrand project for details).

Designs before

Inconsistent UI components used throughout products, creating a jarring user experience.

DESIGNS AFTER

Consistent UI components and copy used throughout channels. Features were moved to different stages in the flow for a more intuitive experience.

05. ENGINEERING HANDOFF

While the backend engineers worked on the framework, I spent my time grooming through the experiences and creating the designs you saw above. Once they were ready to add it into their sprint, I handed over the components via Zeplin.

NEXT STEPS & RETROSPECTIVE

We did not have the bandwidth to conduct user testing for this project so my next step would be to track customer interaction via Heap Analytics and to conduct thorough user testing. This project was the foundation for an entirely new end-to-end experience with up-to-date technology and user-centered best practices and the company was looking forward to reimaging the entire product experience.